Singapore has long been recognized as a global financial hub, known for its business-friendly environment and strategic geographic location. In recent years, the Singaporean government has made significant strides to position the city-state as a leading technology and innovation hub. A key component of this strategy has been the introduction of new technology-oriented tax incentives designed to attract global tech companies, stimulate local innovation, and ensure sustained economic growth. This article explores the various tax incentives introduced by Singapore, their implications for businesses, and their role in shaping the nation’s technological landscape.

Refundable Investment Credit (RIC)

Singapore is seeking to encourage investments in technology and sustainability through tax incentives. In particular, in Budget 2024 the government of Singapore announced the introduction of the Refundable Investment Credit (RIC). The objective is to encourage companies to make sizeable investments that bring substantive economic activities to Singapore, in key economic sectors and new growth areas.

The economic activities that will be incentivized by the tax credit include:

- Investing in new productive capacity (e.g., new manufacturing plant, production of low-carbon energy);

- Expanding or establishing the scope of activities in digital services, professional services, and supply chain management;

- Expanding or establishing headquarter activities, or Centers of Excellence;

- Setting up or expansion of activities by commodity trading firms;

- Carrying out R&D and innovation activities; and

- Implementing solutions with decarbonisation objectives.

The RIC will be awarded by the Singapore Economic Development Board (EDB) and Enterprise Singapore (EnterpriseSG) and is based on the qualifying expenditures incurred by a firm. The RIC is granted based on eligible expenses incurred by the company for a qualifying project during the designated period. Each RIC award has a qualifying period of up to 10 years. The credits can be used to reduce the Corporate Income Tax payable. Any unused credits will be refunded to the company in cash within four years after the company meets the conditions for receiving the credits.

Qualifying expenditures include:

- Capital expenditure (e.g. building, civil and structural works, plant and machinery, software);

- Manpower costs;

- Training costs;

- Professional fees;

- Intangible asset costs;

- Fees for work outsourced in Singapore;

- Materials and consumables; and

- Freight and logistics costs.

Companies can receive up to 50% of credit on each qualifying expenditure category, depending on the assessment of the EDB or EnterpriseSG.

Singapore Artificial Intelligence Strategy 2.0

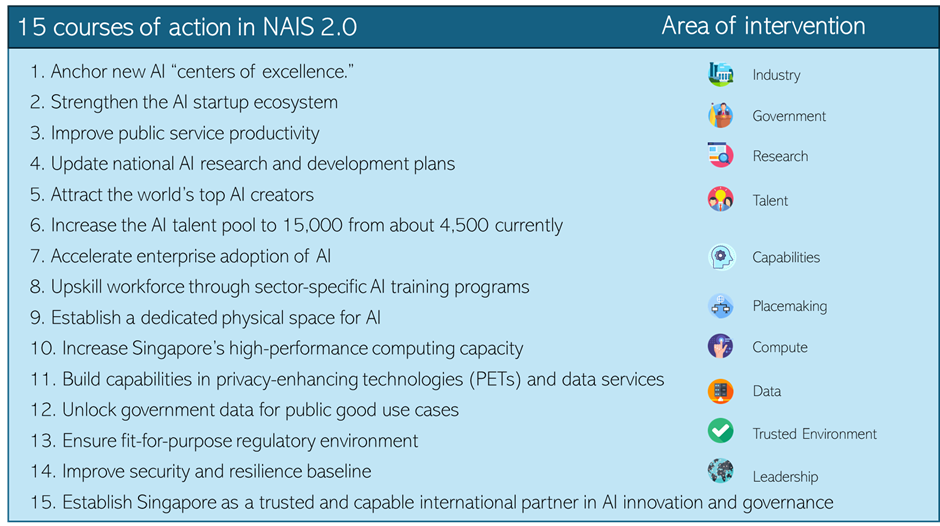

Singapore’s Artificial Intelligence Strategy 2.0 aims to position the nation as a global AI leader by fostering industry growth, enhancing government productivity, advancing research, attracting top talent, and building robust AI capabilities. The strategy includes establishing new AI centers of excellence to encourage value creation and promote sectoral excellence, strengthening the AI startup ecosystem by attracting venture builders and developing accelerator programs, and improving public service productivity through targeted AI strategies. It emphasizes updating national AI research plans, encouraging industry-academia collaboration, and expanding international research efforts.

To attract top AI talent and increase the AI workforce to 15,000, the strategy includes redesigning the AI Apprenticeship Program and promoting hybrid working arrangements. Additionally, it seeks to accelerate enterprise AI adoption and upskill the workforce with sector-specific training. Placemaking initiatives involve creating a dedicated AI space, while efforts to enhance compute capacity focus on partnerships with chipmakers and cloud services. The strategy also prioritizes building capabilities in privacy-enhancing technologies, unlocking government data for public good, ensuring a fit-for-purpose regulatory environment, and improving cybersecurity. Ultimately, Singapore aims to be a trusted international AI partner by increasing its presence in global AI discourse and aligning with key international partners.

Over the next three years, the government will invest some S$20 million (US$15 million) in scholarships for Singaporean students planning to pursue a career in AI. This opportunity will be open for undergraduate, master’s, and PhD degrees. As such, the city-state plans to triple the AI workforce to over 15,000 over the next five years. Moreover, part of the budget will be allocated to invite AI visiting professors to drive research and provide training opportunities to local students over the next five years.

Singapore in the Value Chain of Multinationals

Singapore’s strategic location, pro-business environment, and advanced infrastructure make it an ideal tech hub for multinational companies (MNCs) seeking to enhance their value chain. Its geographic position offers seamless connectivity to the Asia-Pacific region, facilitating efficient supply chain management and rapid market access. The government’s progressive policies, such as tax incentives for innovation and technology activities, create a cost-effective and attractive business environment. The robust innovation ecosystem, supported by significant R&D tax incentives and initiatives like the Intellectual Property Development Incentive, allows MNCs to develop and commercialize cutting-edge technologies effectively.

Moreover, Singapore’s commitment to workforce development ensures a steady supply of skilled professionals, reinforced by programs designed to increase the talent pool in key technological areas. The city-state’s advanced digital infrastructure and strong focus on cybersecurity provide a secure and reliable environment for tech operations. Additionally, Singapore’s proactive regulatory approach and active participation in international collaborations position it as a trusted and capable global player in technology and innovation. Integrating Singapore into their value chain enables MNCs to leverage these advantages, driving operational efficiency and promoting long-term success in the global market.